NFT Utility Beyond Art: Ticketing, Memberships, and Real-World Assets

When you hear “NFT,” your mind probably jumps to digital art—Bored Apes, CryptoPunks, or maybe that viral pixelated rock. But here’s the thing: NFTs are so much more than JPEGs. They’re evolving into powerful tools for ticketing, exclusive memberships, and even representing real-world assets. Let’s break it down.

NFTs as Event Tickets: No More Scalpers or Fake Passes

Imagine buying a concert ticket that can’t be duplicated, scalped, or lost. That’s the promise of NFT ticketing. Companies like GET Protocol and YellowHeart are already using blockchain to issue tickets as NFTs. Here’s why it works:

- No fraud: Each ticket is unique and verifiable on the blockchain.

- Resale control: Artists can cap resale prices or take royalties.

- Fan engagement: NFTs can unlock perks (backstage passes, merch discounts).

Remember when Ticketmaster’s fees made you wince? NFT ticketing could—finally—fix that.

Memberships and Subscriptions: The New VIP Pass

NFTs aren’t just for events. They’re reinventing how clubs, brands, and communities handle memberships. Think of them like a digital “members only” card—but smarter.

How It Works

Hold an NFT, and you get access. Lose it (or sell it), and your perks disappear. Simple. For example:

- Bored Ape Yacht Club: NFT holders get invites to real-world parties.

- Flyfish Club: A members-only restaurant where your NFT is your reservation.

- Newsletters: Some writers tokenize subscriptions (own the NFT, read the content).

Honestly, it’s like having a backstage pass to… well, everything.

Real-World Assets: From Houses to Sneakers

This is where it gets wild. NFTs are starting to represent physical things—homes, cars, even designer shoes. Here’s the deal:

Fractional Ownership

Buying a $2M penthouse? Tough. Buying 1/100th of it as an NFT? Doable. Platforms like RealT tokenize real estate, letting investors own slices of properties.

Provenance and Authenticity

Luxury brands (looking at you, Nike and Gucci) use NFTs to verify authenticity. Scan the NFT, confirm your sneakers aren’t fakes. Boom.

| Asset Type | NFT Use Case |

| Real Estate | Fractional ownership, deeds |

| Collectibles | Proof of authenticity |

| Vehicles | Title transfers, maintenance logs |

Suddenly, that NFT isn’t just a doodle—it’s a deed, a receipt, a certificate of authenticity.

The Roadblocks (Because Nothing’s Perfect)

Sure, this all sounds futuristic. But there are hiccups:

- Adoption: Not everyone knows how to use a crypto wallet… yet.

- Regulation: Governments are still figuring out how to tax/track NFT assets.

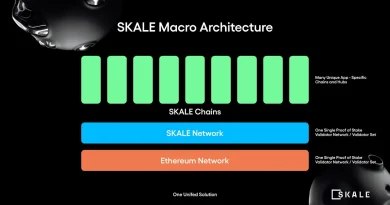

- Scalability: Blockchains get clogged. Solutions are coming, though.

That said, the momentum is undeniable. The question isn’t if NFTs will expand beyond art—it’s how fast.

Final Thought: The Invisible Infrastructure

NFTs might fade into the background—like barcodes or QR codes did. You won’t “see” them; you’ll just use them. Tickets, keys, deeds… all quietly powered by blockchain. And that’s when the real revolution begins.